Triaging Technology – Together

To meet the biopharmaceutical industry’s need for improved analytical solutions, Malvern has developed a new approach. Promising technologies derived from a range of sources are rapidly evaluated in close collaboration with biopharma companies, with the best being selected for fast-track development.

The breakneck pace of change in the biopharmaceutical sector is challenging many of the established ways that the analytical instruments industry does business. For bold and creative companies and organizations, this opens up exciting new opportunities for collaboration. As an example of this, at Malvern we’ve taken a radical approach by establishing in 2012 the Bioscience Development Initiative (BDI), an incorporated company within the existing organization. BDI is both independent of Malvern and synergistic with it, and is the vehicle through which we aim to identify and target emerging technologies and be fleet of foot in developing them.

Why be different?

While there is still significant investment in the development of small molecule pharmaceuticals, the seismic shift in enthusiasm and financial focus that is driving the industry in the direction of biologics is inescapable. Biological therapeutics have already moved beyond ‘basic’ monoclonal antibodies to increasingly sophisticated antibody-drug conjugates, bispecific antibodies, antibody fragments, peptides, and liposomes for targeted delivery, illustrating the huge potential of the sector.

Those working at the leading edge of biopharmaceutical research need analytical tools that will help solve this week’s problem, not last month’s or last year’s. Anticipating the ‘known unknowns’ and more especially the ‘unknown unknowns’ of biopharmaceutical research is testing the ingenuity of all concerned. Plus, the rapidly evolving analytical and regulatory requirements add additional complexity, a good example being the opening of the market to biosimilars, the generic equivalent of biopharmaceuticals.

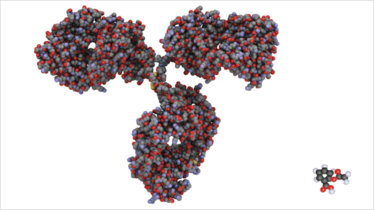

Figure 1, which illustrates the difference in size between a protein and a small drug molecule, captures the reality of biological pharmaceuticals: protein therapies are very different. They’re not the solid dosage forms that the pharmaceutical industry knows so well. They’re not powders. They’re not tablets. They’re delivered intravenously in solution. They’re grown, not synthesised or crystallized. The analytical technology to address questions of quality assurance and quality control, and to generate essential data for the pre-formulation and formulation phases of these novel products, is very different from that which the pharmaceutical industry has historically deployed.

Fig 1. The relative size and complexity of biologic and small molecule drug.

Another key driver is cost. While small molecules can be produced at a dollar a gram, providing plenty of material to test, the production of bio-therapeutics costs orders of magnitude more and the quantities available for analysis at the development stage are orders of magnitude less.

A lot of analytical bottlenecks are only now being recognized by the industry, such as the determination of protein aggregation which can affect quality, efficacy and safety. Nanoparticle analysis is also an important consideration that didn’t exist a decade ago: some 150 recent new drug applications contain the word ‘nanomaterials’.

Understanding what can be measured and what will provide meaningful predictive information on quality, as well as anticipating what measurements will be needed in the future, are massive challenges. That is why Malvern’s BDI has been established. We are partnering with major biopharma industry players, encouraging them to share their challenges, and with the leaders in technology development, be they part of established organizations, working in small companies or in academia. BDI’s ability to engage both sides of the market is critical to the development of optimal solutions.

Malvern’s roots are in particle characterization technology. Over the last decade, our portfolio, capabilities and expertise expanded into materials, biomaterials and biophysical characterization, with a focus on the pharmaceutical industry. We have 40 years’ experience in developing, manufacturing and marketing analytical instrumentation, and some of the industry’s most talented scientists and engineers. The swing towards biopharmaceuticals set us a new challenge: What would be the best way to harness this capital? How should we develop an entrepreneurial approach that utilizes our expertise and experience to greatest effect in this new and highly dynamic market environment?

Finding the solution

The Malvern BDI is incorporated in the USA, operating from a facility in Columbia, Maryland. It is decentralised, a separate development group focussed on intellectual property and addressing the sea change in the pharmaceutical industry.

We don’t believe that Malvern will come up with all of the good ideas for instrumentation, so we have a broad remit that considers three sources. One is technology acquisition: we go out and assess ideas from many different places. Another is through licensing agreements, which could be with small companies or universities. And some products will, of course, come about through organic development within the company. These three pipeline sources will come together to shape Malvern’s long-term strategy for this market.

Once we have the product leads, we are working on shorter, tighter, customer-facing development cycles. We recognize that it’s not just industry R&D that is changing, the regulatory environment is evolving too. Biopharmaceutical companies have to keep pace, whether for biosimilars or simply in relation to the efficacy and safety of biological products.

How BDI works

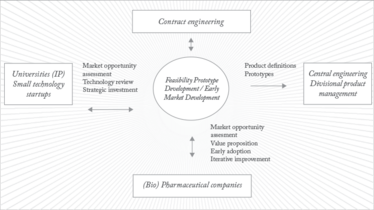

The structure of our workflow is illustrated in figure 2.

It places BDI at the center; this includes people such as project managers and high level scientists. To the left sit universities, intellectual property (IP) and small technology start-ups. We in BDI are constantly assessing the opportunities that these sources present and we can invest in promising technologies to bring them to market more quickly. However, the really unique aspect of the approach is that we take some of these embryonic ideas – ones that may not be quite ready for ‘prime time’ as fully fledged products but are far too interesting to ignore – and push them straight into biopharmaceutical companies. What we are looking for from biopharma is quick, iterative learning.

In the dialogue and testing process it may become apparent there is a compelling technology or product. Most developers don’t have the resources to quickly embed into an environment like biopharmaceuticals so we can move development over to Malvern Limited, into the regular engineering and product management team – the right hand part of the picture.

Fig 2: The BDI workflow

This is a quite different approach from traditional analytical instrument development, which generally involves generating a requirement specification, producing a prototype, testing it against the requirement specification and continuing along a well-trodden pathway through to launch. Within BDI we’re talking to biopharma customers early and bringing them right into the development loop, pushing the prototype back to them. The reaction from most of the major biopharmaceutical companies we’ve talked to has been overwhelmingly positive. They want to be part of the development process and welcome being able to help direct it. Essentially we’re providing a relatively low-risk opportunity for them to test out novel ideas, in some cases to immediately apply them and steal a march on the competition, and to provide feedback that helps determine the next step.

The idea is really resonating in an industry that acknowledges ‘we don’t know what we don’t know’. Through BDI, Malvern can bring technologies to the table that perhaps no-one has heard about, show a prototype, run some samples, or bring it into the biopharma facility. Then we look at the data together and determine whether or not this technology or product has some utility. If it’s not going to solve any problems, we cut if off at the pass. While no-one likes to fail, the mentality within BDI is ‘fail fast, fail cheap’. In a market so fluid that you can’t guarantee it’s going to be the same in six or twelve months, let alone two or three years, who wants to be responsible for developing the answer to a redundant question?

It’s pretty clear that to bet right now on a single technology in the biopharma market would be risky, so we’re spreading the bet across a number of different technologies. Through interaction with customers we will determine the likely winners, triaging as we go. This can only work through high-level partnering, with ‘the customer‘, who at some point we hope will become a real paying customer. For now, it’s amazing the number of people I’ve talked to who have said, “We really like that idea. It allows us to spread our options and really figure out what’s helpful for us.”

The first products from BDI are already coming through. They include an agreement with Affinity Biosensors to employ their Resonant Mass Measurement technology to detect and count particles in the size range 50 nm - 5 µm, especially useful for characterizing protein aggregates in a formulation or buffer, and the results of a partnership and development program with a small company to develop microviscosity measurement technology, which will be marketed as a full Malvern product later in 2013.

We are continually seeking out technologies, adding them to our toolbox and trying to evaluate them as quickly as we can in terms of market suitability. We know things are changing. The customer knows they’re changing. The FDA knows they’re changing. There is no room for any of us to be sluggish. BDI is a capacitor, or an interface, with the ability to embrace and assess the changes and seamlessly slide new technologies into the mainstream portfolio.

E. Neil Lewis received his PhD in chemistry from the Polytechnic of Wales, UK, and did his postdoctoral fellowship at the National Institutes of Health (NIH) in the USA. He was tenured by the NIH in 1992 holding the position of Senior Biophysical Researcher. He is the founder of several high technology companies, including Spectral Dimensions, Inc., and he has been at the forefront of the development of these technologies. He has authored more than 70 papers, book chapters and patents and has received numerous prestigious awards. After the sale of Spectral Dimensions, Inc. to Malvern Instruments Ltd. he was appointed to Malvern’s Board of Directors and holds the position of Chief Technology Officer (CTO).