Twenty years ago, mass spectrometry swept into the field of bioanalysis and rapidly replaced existing detection methods, such as UV. As a result, pharma was able to scale-up pharmacokinetic (PK) and toxicokinetic measurements in drug discovery and development like never before, allowing portfolio decisions to be based on circulating in vivo concentrations rather than merely the dose administered. Nowadays, bioanalytical measurements extend far beyond drug concentrations in plasma, and support a more translational medicine-centric mind set within the pharmaceutical industry. Increasingly, data-rich preclinical and clinical trials demand much more from limited R&D budgets, and to keep costs manageable, the pharma industry often looks to develop partnerships with contract research organizations (CROs). Indeed, the majority of regulated bioanalytical work is conducted at CROs. The pharma-CRO partnership should be mutually beneficial but, in reality, innovation in bioanalysis has faltered – caused in no small part by the evolutionary course of the arrangement. Given the current high level of outsourcing, CROs have become the majority shareholder, while pharma has seen a concomitant contraction of internal capital expenditure and bioanalytical staff. In parallel, today’s marketplace for novel medicines means that pharma procurement groups must maximize return on investment (ROI) for any externalized activities, with the goal of getting medicines to market at a price tolerable to payers, shareholders and healthcare providers alike. In turn, CROs are under pressure to keep costs low.

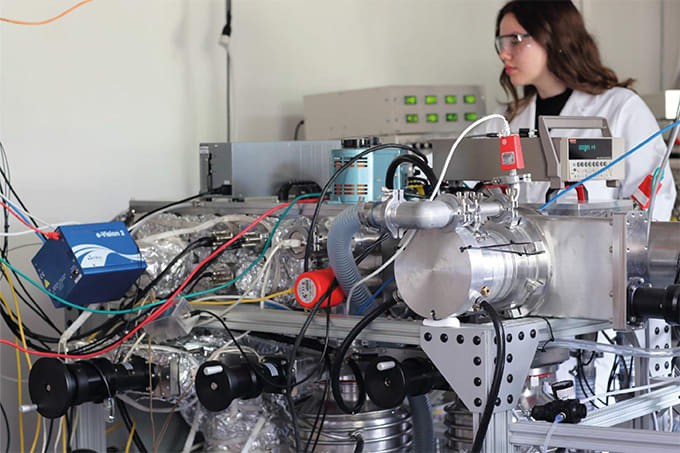

Oftentimes, significant investment is required to adopt a new technology. Justifying the original capital outlay will almost certainly need recurring revenue, and then there is a significant training burden, regulatory uncertainty and a need to “pull” pharma companies to agree to using innovative workflows on fledgling drug products. Whereas pharma looks at the long game of new medicine development, bioanalytical CROs are inherently more focused on short-term results; business is booming for CROs, so why change? Larger CROs can afford to be rapid followers, skipping the risk of trailblazing. Smaller CROs simply can’t afford to invest more capital into newer technologies and remain competitive. CROs may be reluctant to update their technology but it’s clear that advances like high resolution mass spectrometry (HRMS) and lab automation will win out in the end; the results speak for themselves. These technologies will not only drive better data quality but will also enable lab scientists to focus on higher-level tasks, rather than holding pipettes or moving 96-well plates around. Momentum is already building; major bioanalytical conferences have more sessions than ever on lab automation and HRMS. However, to speed up adoption, we need a collaborative endeavor involving vendors, CROs and pharma that looks at how we can reduce cost and risk. Pharma must take its fair share of the innovation burden. In our own laboratories, the philosophy is now to embed new technologies more assertively into internal support and bring them into the early regulated environment. The resulting efficiency gains allow us to retain more bioanalytical activities on strategically important assets, or divert skilled scientists to more challenging tasks.

The next step is to push these technologies into receptive CRO partners – we believe CROs are much better placed to drive industrialization and scalability. The value that we can bring to internal support should and must translate to even greater value in our outsourced activities, with improved efficiency in CROs leading to lower costs or increased capacity for pharma. There are a number of exciting CRO start-ups that are aiming to disrupt the bioanalytical sector, including highly automated platforms that would slash the costs of delivering regulated bioanalytical support by providing i) reduced outsourcing costs for pharma, and ii) 24/7 scalability for CROs based on instrument cells rather than recruitment. The technology is ready and waiting, so the question now is: who will be the key players in bioanalysis 2.0 – and who will be caught napping?